Positions

What is this money used for?

Why should local funds be restored?

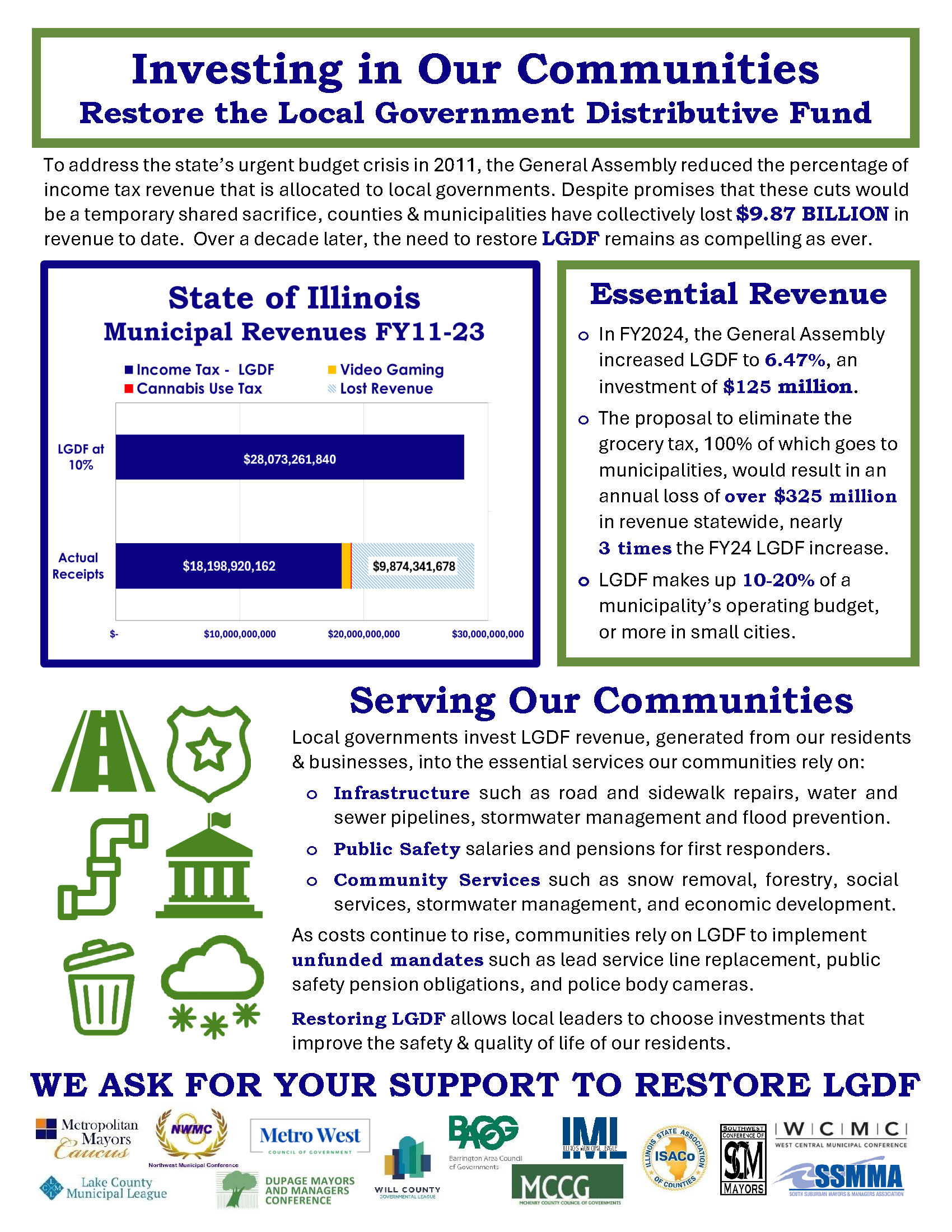

Restoring LGDF will reduce pressure on property taxes and other revenue sources, especially in small and non-home rule communities. To make up for LGDF losses since 2011, municipalities and counties have been forced to consider tough decisions such as cutting services, laying off personnel or raising property taxes, which are already among the highest in the nation. Additional funding could be used to improve the safety and quality of life for residents throughout Illinois -- all without raising your local property taxes.

The best way to ensure stability in the services residents rely on is for Illinois lawmakers to restore LGDF funding to the agreed-upon 10 percent rate.

Who is supporting this effort?

State Representative Anthony DeLuca (D-Chicago Heights) and State Senators Laura Murphy (D-Des Plaines) and Don DeWitte (R-West Dundee) are leading the fight to Invest In Communities and have introduced legislation in the General Assembly to restore the Local Government Distributive Fund. The below Councils of Government, representing 275 municipalities and 29 counties across Illinois, are helping to spread the word on the importance of restoring local funding:

Statewide Fact Sheets

LGDF stands for Local Government Distributive Fund, which is the portion of State income taxes that is returned to the communities where they are generated on a per capita basis. This system was established more than 50 years ago instead of allowing local governments to implement their own income taxes.

In 2011, Illinois lawmakers started taking a larger share of the local pie – returning less than the agreed-upon 10 percent portion back to local governments. When state lawmakers increased the state income tax that year, none of that increase was allocated to local communities. In FY24, the General Assembly increased LGDF from 6.16 percent to 6.47 percent, investing an estimated $130 million in additional revenue to Illinois municipalities and counties. Communities are only beginning to see the benefits of this first step toward restoration, and additional increases in LGDF will compound these returns on investment.

If you would like to learn more about the impact on your community, click here.

Additional information is also available on the Illinois Municipal League website.

Contact Your Legislators

If you're interested in advocating your community, reaching out to your State legislators can be a powerful way to make your voice heard. You can then reach out to them via email, phone, or social media to express your concerns and make your case for the community. Remember, the more engaged citizens are in the political process, the more responsive and effective government can be.